Reporting by Steve Holland; Editing by Sandra Maler and Jamie Freed

Trump U-turns on tariffs but keeps trade war heat on China

The upheaval erased trillions of dollars from stock markets and led to an unsettling surge in U.S. government bond yields that appeared to catch Trump’s attention.

“I thought that people were jumping a little bit out of line, they were getting yippy, you know,” Trump told reporters after the announcement, referring to jitters sportpeople sometimes get.

U.S. stock indexes shot higher on the news, with the benchmark S&P 500 (.SPX), opens new tab index closing 9.5% higher. Bond yields came off earlier highs and the dollar rebounded against safe-haven currencies.

The relief spread through Asian markets as they opened on Thursday with Japan’s Nikkei index (.N225), opens new tab surging 8% while European futures also pointed to a sharp rebound. Even Chinese stocks rose, propped up by hopes of state support, although its yuan currency fell to the lowest level since the global financial crisis.

)

‘GOADED CHINA’

Reporting by Reuters newsrooms; Writing by Andy Sullivan, James Oliphant and John Geddie; Editing by Nick Zieminski, Matthew Lewis and Lincoln Feast

Chinese sellers on Amazon to hike prices or exit US as tariffs soar, association says

SHENZHEN, China, April 10 (Reuters) – Chinese companies that sell products on Amazon (AMZN.O), opens new tab are preparing to hike prices for the U.S. or quit that market due to the “unprecedented blow” from President Donald Trump’s tariff hikes, the head of China’s largest e-commerce association said.

Trump said on Wednesday he would raise tariffs on Chinese imports to 125% from the 104% level already in effect, escalating the high-stakes confrontation between the two world’s largest economies.

“This isn’t just a tax issue, it’s that the entire cost structure gets entirely overwhelmed,” said Wang Xin, the head of the Shenzhen Cross-Border E-Commerce Association, which represents more than 3,000 Amazon sellers.

“It’ll be very hard for anyone to survive in the U.S. market,” she told Reuters.

Some sellers are looking to increase prices in the U.S. while others are looking to find new markets, Wang said.

The tariffs will severely impact China’s small enterprises and manufacturers and also rapidly accelerate the country’s unemployment rate, she added.

Reporting by David Kirton; Editing by Jamie Freed

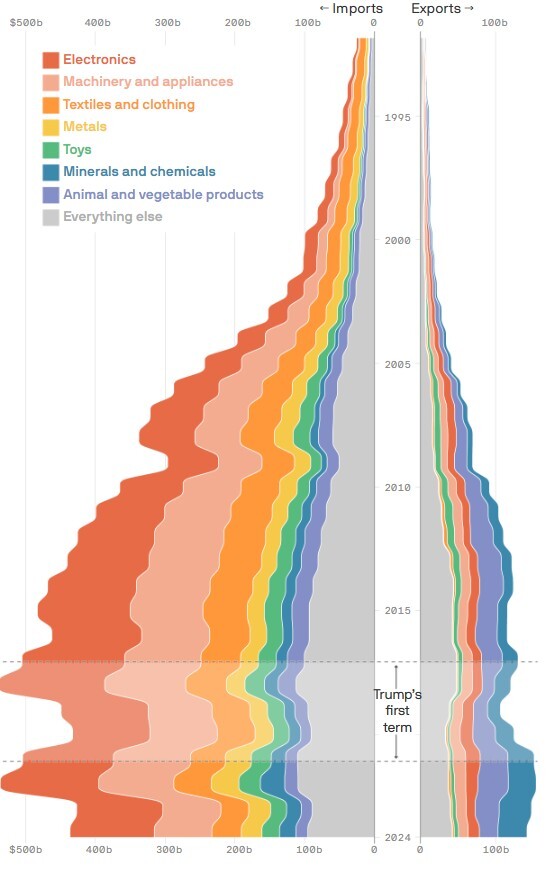

Charted: What does the U.S. export to China

U.S. trade with China

China retaliated against President Trump’s tariffs on Wednesday with a new 84% levy on exports from the U.S., threatening American jobs and industry that rely on the crucial trade partner.

Why it matters: There’s very little modern precedent for one of the largest importers of U.S. goods throwing up such a giant barrier. The full scope of the consequences for the economy are not yet clear.

- Trump on Wednesday afternoon paused the administration’s sweeping reciprocal tariffs on dozens of countries for 90 days — except those for China, which he raised to 125%. He kept 10% baseline tariffs in place.

By the numbers: In 2024, U.S. exported $143.5 billion worth of goods and materials to China, down 2.9% from 2023, according to the Office of the U.S. Trade Representative.

- More than 930,000 jobs were supported by U.S. exports to China alone in 2022, per a 2024 report from the U.S.-China Business Council.

- “Jobs supported by exports to China outnumber those supported by the next two Asian markets combined,” the report stated.

China was the third-largest export market in 2023 for the U.S., the report said, with oilseeds and grains as the top exports.

- By state, Texas, California and Louisiana were the top U.S. exporters to China in 2023.

- Texas saw 146% growth over the previous 10 years.

The big picture: Trump instituted sweeping tariffs in an attempt to reorder the global economy, but economists and U.S. allies have said his plan could lead to a recession.

- The U.S. trade deficit with China (imports minus exports) has been larger than $200 billion since 2005, and it reached a record high of $418 billion during the second year of Trump’s first administration.

- Top U.S. imports from China in 2022 were electronics, machinery and appliances, toys and games, textiles and chemical products, according to the Council on Foreign Relations.

China, EU launch massive U.S. tariff retaliation

China and the European Union retaliated on Wednesday against President Trump’s tariffs with new levies on more than $150 billion of U.S. exports.

Why it matters: The levies are the latest escalation stemming from Trump’s trade war, which is deepening even as the U.S. says it’s open to negotiations.

- The blanket 84% Chinese tariffs will be devastating for U.S. farmers, who are major exporters to China. The targeted 21 billion euros of European levies, while smaller, will also hit the agriculture economy.

Between the lines: The U.S. exports about $145 billion in goods to China a year.

- That trade is dominated by oilseeds and grains, per the U.S.-China Business Council.

- Exports to the EU are much larger, north of $370 billion, though Europe’s retaliation package is much more targeted than China’s broad levy.

Catch up quick: The trade tit-for-tat started when Trump put a 10% tariff on imports from China, alleging it was failing to control the flow of fentanyl out of the country.

- He later doubled that to 20%.

- Subsequently, Trump introduced a reciprocal tariff of 34% on China, which stacked on the drug tariffs. When the Chinese retaliated with a matching levy, Trump added another 50%.

- That means that as of 12:01 a.m. ET Wednesday, the U.S. now charges a 104% tariff on imports from China.

By the numbers: Stocks were broadly lower around the world, though more heavily in Europe and Asia than the United States.

Why Trump decided to take the win and paused tariff war

Donald Trump finally decided to take the proverbial “win” on trade and the stock market rallied nearly 3,000 points.

You can thank the bond market, with an assist from Treasury Secretary Scott Bessent, for making it happen.

We have been hyper-focused on how the stock market dropped ever since Trump declared trade war on the entire world, how he kept upping the ante, demanding ever higher degrees of compensation from our trade partners, even those who appeared to be acting in good faith and wanting to negotiate peace.

Trump’s trade intransigence was a reflection of his own oft-stated desire to level the playing field, ending our perpetually large trade deficits with the world.

Also certainly in the back of his “art-of-the-deal” mindset was an attempt to maximum leverage in negotiations.

He was also goaded by two of the most hawkish and protectionist advisers to have ever set foot in the White House: Howard Lutnick, the commerce secretary, and Peter Navarro, who holds the title as senior counsel to the president.

Pushed aside, until recently that is, was Scott Bessent, a veteran Wall Street financier who sought a middle ground, doing deals with countries but not engaging in outright war.

The hawks seemed to be firmly in control even as markets around the world continued to crater, the US stock indices losing trillions of dollars in value.

Trump continued to ignore olive branches from the EU, which stated publicly it wanted zero tariffs with the US on many goods; Trump even kept toying with Israel, one of our closest allies, after Prime Minister Benjamin Netanyahu told him he’d eliminate all tariffs on US goods, wipe out the trade deficit with the US.

That long game came to an end Tuesday night in the form of a bond market rout for the ages.

Main Street can weather some stock market falls.

But the US has $36 trillion in bonds in circulation, much of it in foreign hands, that we use to finance government operations.

The bond market is also the plumbing of the economy because it also sets interest rates on consumer and business loans.

If the US can’t sell its debt, it can’t pay for stuff like Social Security, the military or plug our enormous deficit.

:max_bytes(150000):strip_icc():focal(753x236:755x238):format(webp)/Pierce-Brosnan-Keely-Shaye-Smith-051024-5e7053baff3e4b979fb808b5b3bcd0ba.jpg?w=1200&resize=1200,0&ssl=1)

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/catherine-ohara-013026-7-4b5b413a646d4f15a1fd15ac8b933811.jpg?w=1200&resize=1200,0&ssl=1)