Trump’s iron grip on congressional Republicans is weakening

![]()

Fear of Trump’s wrath ripples through House GOP

President Donald Trump faced Republican defections on a series of split votes this week, but his willingness to call out members of his own party convinced some wavering lawmakers to stay in line.

On Thursday, Trump was quick to say five Republican senators should not be reelected to Congress after they voted with Democrats to advance an effort to limit future US military force in Venezuela without congressional approval.

Hours later, House Republicans were faced with an opportunity to override the first presidential vetoes of Trump’s second term. The stark example of the president’s readiness to target members of his party led some GOP lawmakers who were debating voting to override the vetoes on a pair of relatively noncontroversial bills not to, multiple sources told CNN.

Nothing had changed about the substance of the bipartisan bills, except now the votes would be viewed as bucking Trump.

“Members who would normally be supportive of other member initiatives have to balance not stepping out of line with the White House,” one of the GOP lawmakers who was considering voting to override but ultimately didn’t told CNN. “Not much room for independence.”

Another GOP lawmaker who spoke with colleagues considering the veto override saw the decision of some of those colleagues as “not wanting to poke the bear.”

Trump’s reflex to use his powerful microphone to target politicians in his own party is not a new phenomenon, and it still did not deter some Republicans from voting in opposition to the president. But, with an increasingly narrow House Republican majority in an election year, it has the potential to play an outsized role. A member could be one phone call or Truth Social post away from being singled out by the president, and that carries extra weight with members eager not to draw a primary challenge or open themselves up to new attacks as Election Day draws closer.

Over the summer when Republicans were working to pass Trump’s domestic agenda, House Speaker Mike Johnson regularly tapped the president to convince holdouts to get on board with the legislation. Countless times, House floor votes were held open so Trump could directly negotiate with GOP lawmakers, and in the immediate days leading up to the final vote, Trump met directly with various lawmakers.

Now, with lawmakers confronting what to do about Americans facing rising health care costs after enhanced Affordable Care Act tax credits expired, Trump has so far taken a much more back seat approach, telling House Republicans on Tuesday it was up to them to “figure it out.” Trump’s mixed messaging on health care gave 17 Republicans more breathing room to buck their party’s leadership and join Democrats in voting to restore enhanced Obamacare subsidies on Thursday.

House Speaker Mike Johnson told CNN after the vote that he understood each lawmaker has to vote their conscience but wished those 17 lawmakers hadn’t rebuffed him.

Many of those Republicans are running in competitive races for reelection and are walking a tight rope of trying to balance their need to get ahead of attacks from their Democratic opponents over the rising cost of health care with their support for the president.

On the balancing act that those lawmakers face, one GOP lawmaker warned: “If you’re going to stick your neck out on this and that but then you want to turn around and beg for an endorsement?”

But GOP lawmakers have predicted once Trump does decide to get involved and point his party in a specific direction on health care, most in the party will fall in line.

“If the president makes something a priority, that has an impact on the process,” GOP Rep. Kevin Kiley of California told CNN.

Another GOP lawmaker described House GOP leadership trying to fill the vacuum left by Trump on health care as a “disaster,” adding that “every member is left to fend for themselves.”

Still, some Republicans, particularly those who are retiring, don’t view Trump as a determining factor for how they approach a given issue.

Nebraska Republican Rep. Don Bacon was considering whether Congress should limit future US military force in Venezuela without congressional approval, until Trump lashed out against the five Republican senators who voted with Democrats.

That helped make up his mind, he said, to support a similar war powers resolution when it comes up in the House.

“It emboldens me,” Bacon told CNN on Friday. “Being bullied by the president doesn’t help. It doesn’t help with me. Other people it may, but not me.”

Bacon, who is retiring from Congress at the end of his term, is one of the few Republicans who regularly speaks out against the president.

“You got to respect people’s decisions on those kinds of things, right? You really do. Some of the comments he made I think drove them to that decision,” Washington state Rep. Dan Newhouse, who is also retiring from Congress and is part of the small group willing to rebuke Trump, told CNN.

Meanwhile, Kentucky Rep. Thomas Massie, who is often in public opposition to Trump, says it’s no coincidence that the president continues to target him.

“I think he’s attacking me to keep the rest of these guys in line,” Massie said. “I think he’s just trying to drive home to them that, ‘Hey, if you don’t stay in line, I’ll give you the Massie treatment.’”

It’s not a coincidence for Massie then that many of his Republican colleagues decided not to override Trump’s veto.

“I do think there was some bully pulpit intimidation going on there,” he said.

![]()

Trump officials see fraud everywhere. Here’s what we know

A 42-minute video from a conservative content creator in Minnesota has provided the Trump administration with yet another opportunity to argue that federal safety net programs are plagued by widespread fraud.

Though investigations have yet to show that child care centers in the state were committing fraud to obtain federal funds, as the video claims, the administration has frozen all federal child care payments to Minnesota and rescinded a Biden-era rule that it says increased the risk of fraud. It has also moved to audit the state’s Medicaid billing and is freezing funds for other programs in five Democrat-led states as it investigates additional potential fraud.

What’s more, the administration will soon name an assistant attorney general tasked with investigating and prosecuting fraud, Vice President JD Vance said Thursday. And the Treasury Department is stepping up its oversight of financial institutions in Minnesota to make sure they are following the rules designed to detect money laundering and other illicit activity — an effort the agency expects to roll out nationally.

While waste, fraud and abuse in the federal government have long been a Republican fixation, President Donald Trump and his officials have taken it to an even higher level — citing fraud in the dispensation of benefits for food stamps, Social Security, Medicaid and Obamacare as reasons to make changes to those programs and others. But some experts argue the administration’s claims are inaccurate or exaggerated.

It’s difficult to pin down just how pervasive fraud is in federal programs, though many examples exist, including in Minnesota, which has suffered from a series of scandals involving social service programs in recent years.

The Government Accountability Office estimated in 2024 that between $233 billion and $521 billion in federal dollars could be lost annually to fraud in a first-of-its-kind government-wide estimate. That represents 3% to 7% of average federal obligations, though the GAO noted the level of risk can vary substantially by agency and program.

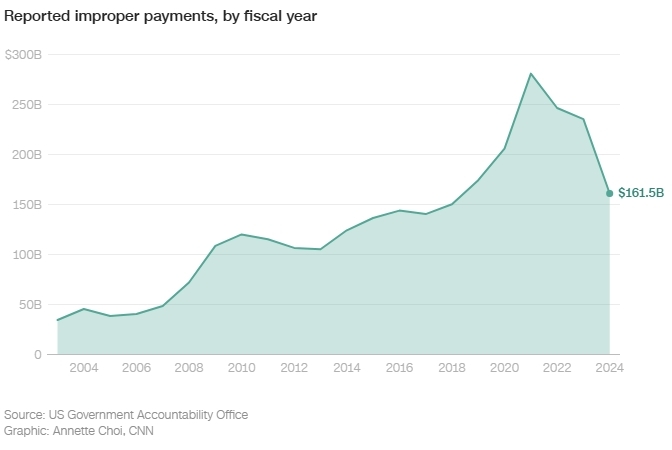

Relatedly, the federal government also made about $162 billion in improper payments across 68 programs in fiscal year 2024, according to the GAO’s review of a small subset of federal programs. The vast majority were overpayments, including to dead people or those no longer eligible for the program. But not all improper payments are fraudulent — some may be due to administrative errors.

Federal improper payments totaled about $162 billion in fiscal year 2024

Improper payments by the federal government decreased about $74 billion in fiscal year 2024 compared with the prior year. This decline was largely driven by the winding down of some Covid-19 programs.

The Covid-19 pandemic relief programs, including the expanded unemployment benefits, attracted a bevy of criminals who took advantage of the federal government’s lowering of its guardrails to get money quickly into the hands of desperate Americans.

“The lesson from the pandemic is how enterprising and opportunistic and coordinated and sophisticated the fraud actors were,” said Linda Miller, founder of the nonprofit Program Integrity Alliance and former senior executive in GAO’s fraud unit. Agencies “were supposed to be learning since then.”

While the GAO has long highlighted the vulnerabilities in federal departments and programs, they often aren’t addressed. Concerns about costs, outdated technology, administrative burdens and privacy, along with pushback from industries and advocates, can get in the way.

“There is a lack of attention, priority, commitment and decisive action at the highest level of agencies, regardless of administration,” said Seto Bagdoyan, a director on GAO’s forensic audits and investigative service team, who believes the fraud estimates are likely understated.

Trump officials have sought to enhance data sharing — both among federal departments and between the federal government and states — to help root out fraud, though such efforts have sparked concerns and lawsuits about privacy and the administration’s targeting of immigrants. Some agencies, along with the GOP-led Congress, have also sought to increase verification requirements for federal benefits.

Data matching, along with AI, can help detect and stem fraud, said Matt Weidinger, senior fellow at the conservative American Enterprise Institute. The government should make greater use of technology to make sure the right people are being paid the right amount.

Weidinger also said he’s not as concerned about the risks of the government sharing people’s personal information considering what criminals already have access to from multiple data breaches in the private sector.

Much of the fraud in federal programs is being perpetrated by transnational crime groups or by providers of services, not by individuals lying to meet eligibility requirements — though that also happens, Miller said.

“There’s so little understanding of the participation of these organized crime groups and how good they are,” she said. “So you look at this fraud, and then you want to blame individual people, especially if your world view is these welfare programs shouldn’t exist.”

Highlighting fraud in federal programs

Trump and top agency officials have called out instances of fraud in various programs to highlight the need for change.

Food stamps: In a cabinet meeting last month, Agriculture Secretary Brooke Rollins said her agency found that 186,000 dead people’s Social Security numbers were being used to collect Supplemental Nutrition Assistance Program, or SNAP, benefits. Also, half a million people were receiving benefits more than twice, while “a couple of people” were receiving benefits in six states.

Last year, the US Department of Agriculture requested for the first time that states provide it with their SNAP enrollee records, but a coalition of Democratic states sued and won a preliminary injunction.

In a November letter to state officials, USDA said an estimated average of $24 million a day of federal funds is lost to fraud and errors undetected by states, based on the records it has received from 28 states. It expects the number to increase when additional states provide their data. Stopping such losses could save about $9 billion or more annually, according to the letter.

Some $10.5 billion in improper payments were made in the food stamp program in fiscal year 2024, according to the GAO.

As part of their “big, beautiful bill,” congressional Republicans approved a measure that will penalize states that have high improper payment rates. It’s a provision that has gotten the attention of state officials and will force them to improve their payment accuracy and practices, Weidinger said.

“When the states have a financial interest in making sure that benefits are not improperly paid, they’re going to pay attention,” he said.

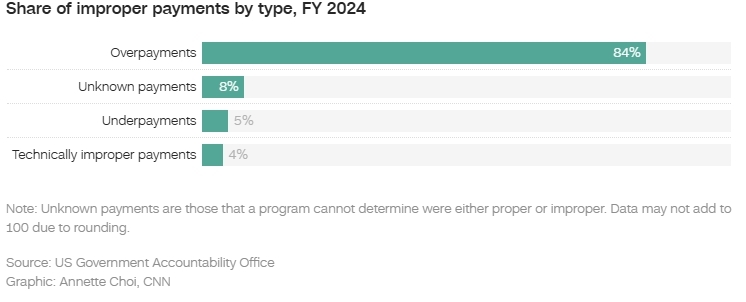

Most improper payments were overpayments

Overpayments, including payments to deceased individuals or those no longer eligible for government programs, made up the majority of the nearly $162 billion in payment errors in fiscal year 2024.

One major fraud problem affecting food stamp recipients is when their benefits are stolen through card skimming. Criminals copy an enrollee’s EBT card information by placing a device on a retailer’s machine and then making fake cards to purchase groceries using the enrollee’s benefits.

Congress passed a law in 2022 temporarily allowing state agencies to use federal funds to replace the stolen benefits, but it expired at the end of 2024.

Medicaid and the Affordable Care Act: Centers for Medicare and Medicaid Services Administrator Mehmet Oz has repeatedly vowed to crack down on fraudulent and improper enrollment in his agency’s health programs.

Some 2.8 million people were enrolled in Medicaid or the Children’s Health Insurance Program in two or more states or had Medicaid or CHIP coverage and a subsidized Affordable Care Act plan in 2024, the CMS announced in July. The agency said it would work with states to reduce duplicate enrollments.

Also, states made nearly $208 million in payments to Medicaid insurers on behalf of deceased enrollees between July 2021 and the end of June 2022, according to a Department of Health and Human Services’ Office of Inspector General report released in December. That included nearly $139 million in federal Medicaid support.

What’s more, the GAO’s covert testing program found that the federal Affordable Care Act exchange approved coverage for nearly all of GAO’s fictitious applicants in 2024 and 2025. CMS paid about $2,350 a month in federal premium subsidies for the four fictitious enrollees in 2024 and more than $10,000 a month for 18 fake applicants in 2025.

GAO also found tens of thousands of Social Security numbers were used to receive more than a year’s worth of coverage with premium subsidies in a single year, while it identified nearly 200,000 applications that likely had unauthorized changes by agents and brokers.

Fraud among agents and brokers increased after the Biden administration approved a temporary enhancement to the premium subsidies in 2021. Biden officials later cracked down on agents and brokers, who were seeking to pad their commissions through the unauthorized enrollments and plan switches.

The “big, beautiful bill” requires states to review the Social Security Administration’s Master Death File on a quarterly basis and mandates that HHS establish a data sharing system to prevent duplicative Medicaid enrollments, though the provisions don’t begin to take effect until 2027.

Much of the fraud in Medicaid, as well as Medicare, stems from providers submitting fraudulent claims.

The Justice Department announced in June that its annual National Health Care Fraud Takedown resulted in criminal charges against 324 defendants, including 96 doctors, nurses and other practitioners involving a record setting $14.6 billion in intended losses. In one operation, a transnational criminal organization bought dozens of medical supply companies and then used the stolen identities of more than 1 million Americans to submit $10.6 billion in fraudulent claims to Medicare for urinary catheters and other medical equipment.

Social Security: Soon after Trump took office last January, he and billionaire Elon Musk began implying that millions of dead people were receiving Social Security benefits. Musk’s Department of Government Efficiency team at the agency argued they needed access to Social Security’s databases to root out this fraud — an effort initially blocked by a federal court but eventually allowed to proceed by the Supreme Court.

The agency also sought to implement various anti-fraud measures, including requiring all those filing benefit applications who could verify their identities through their online “my Social Security” account to visit a field office to complete the claim in person. It also began holding retirement benefit applications for three days to check for fraud. And it prohibited beneficiaries from changing their bank account information through the agency’s call center.

Some of the measures were eventually dropped amid an outcry from advocates or little evidence of fraud.

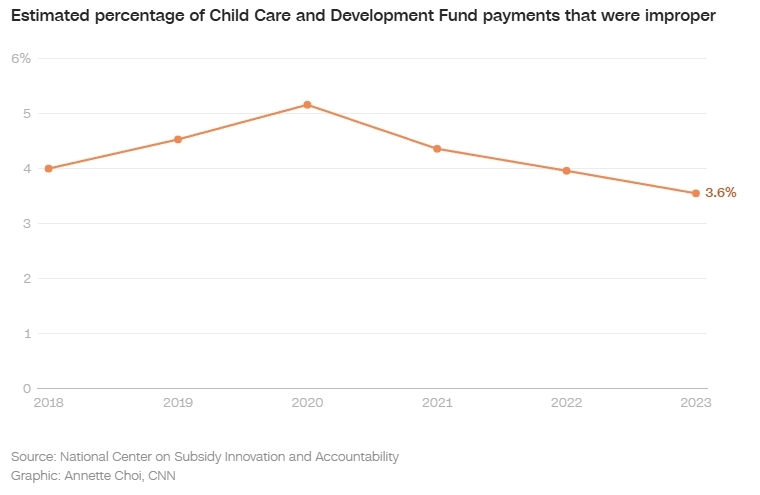

Child care: An estimated 3.6% of payments from the Child Care and Development Fund grant program were improper in 2023, according to a report from the Office of Child Care’s National Center on Subsidy Innovation and Accountability. About 39% of the improper payments were due to missing or insufficient documentation, including paperwork verifying income, work and residency.

Improper Child Care and Development Fund payments hit a six-year low in 2023

The national error rate for 2023 was 3.6%, which falls well below the 10% or less threshold for the Office of Child Care.

HHS is now freezing child care and certain social assistance payments in several states in the wake of a widening probe into whether providers in Minnesota were collecting federal funds for children that were not attending their centers.

Plus, HHS this week rescinded a 2024 rule that it said weakened oversight and increased the risk of fraud, waste and abuse in the Child Care and Development Fund program. The change allows states to require payment based on verified attendance, rather than enrollment, and to pay providers after care is delivered, rather than at the start of the month.

“Loopholes and fraud diverted that money to bad actors instead,” HHS Secretary Robert F. Kennedy, Jr. said in a statement. “Today, we are correcting that failure and returning these funds to the working families they were meant to serve.”

But Ruth Friedman, who directed the Office of Child Care during the Biden administration, said that the Trump administration announced it was reviewing the rule last summer, well before the Minnesota scandal burst into the spotlight. Trump officials signaled to states at the time that the reason for updating the rule was to give states more flexibility and lower their costs.

The rule was designed to help child care centers financially and was in line with private industry practices, she said, noting that nearly half of states — both red and blue — were already basing payment on enrollment.

“The Trump administration’s decision to rescind the Biden child care rule has nothing to do with fraud, but it does send a clear message that they aren’t interested in helping families afford child care, or the small businesses that keep our economies and communities working,” she said.

HHS did not respond to a request for comment.

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/catherine-ohara-013026-7-4b5b413a646d4f15a1fd15ac8b933811.jpg?w=1200&resize=1200,0&ssl=1)