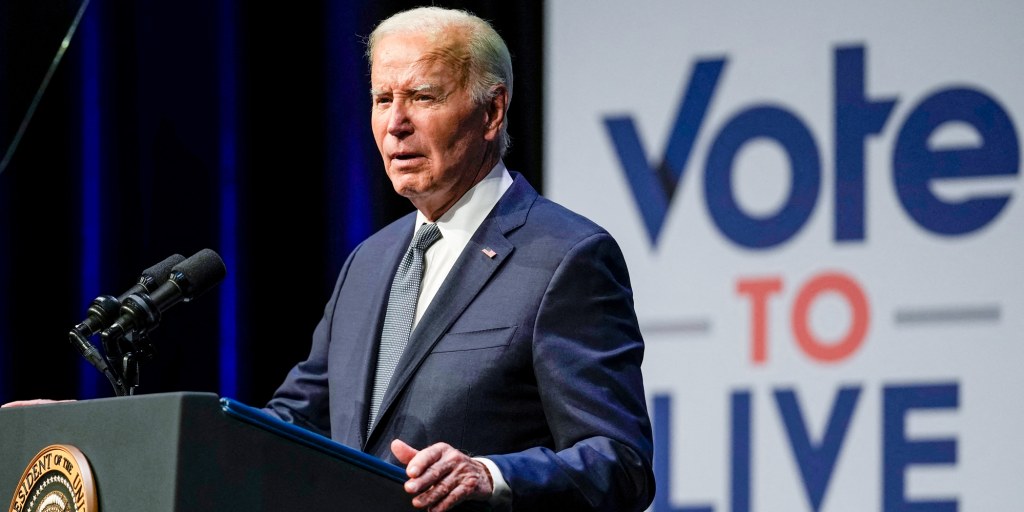

Damning Report on Biden Reveals How He Was Struggling From Beginning

The Wall Street Journal published a bombshell report Thursday, based on interviews with nearly 50 people knowledgeable of the operations of the Biden White House. The story details the extent to which the president’s age has posed an issue throughout his presidency, including from the very start, and the lengths to which aides went to conceal it.

President Biden, now 82, was 78 years old when he took office, and the Journal reports that administration officials began to notice signs of his age “in just the first few months of his term,” as he would grow “tired if meetings went long and would make mistakes.”

Those who met with the president were reportedly told that “exchanges should be short and focused.” Meetings were strategically scheduled and, sometimes, if Biden “was having an off day,” they were simply canceled. A former aide recalled a national security official saying, regarding one rescheduled meeting, “He has good days and bad days, and today was a bad day so we’re going to address this tomorrow.”

The Journal reported that lawmakers, Cabinet members, and the public all seemed to have less face time with the president than in previous administrations and that senior advisers were “often put into roles that some administration officials and lawmakers thought Biden should occupy.” Namely, administration officials like Jake Sullivan, Steve Ricchetti, and Lael Brainard frequently functioned as intermediaries for the president.

House Armed Services Committee Chair Adam Smith reportedly sought to reach Biden ahead of his withdrawal from Afghanistan “but couldn’t get on the phone with him.” Smith noted that he was more frequently in touch with Barack Obama when he was president, though he wasn’t then the House Armed Services chair. Representative Jim Hines, ranking member on the House Intelligence Committee, similarly told the Journal, “I really had no personal contact with this president. I had more personal contact with Obama, which is sort of strange because I was a lot more junior.”

As for Biden and his Cabinet members, the Journal reports that interactions “were relatively infrequent and often tightly scripted.” One reportedly gave up on trying to request calls with him altogether “because it was clear that such requests wouldn’t be welcome.” The report reveals too that Biden struggled to “recall lines that his team had previously discussed with him” as he prepared for his interview with special counsel Robert Hur—who was investigating whether Biden mishandled classified material and in February determined that a jury would consider him “a sympathetic, well-meaning elderly man with a poor memory.”

On the 2024 campaign trail, the report says, Biden’s team often vetted questions from event attendees in advance. Pollsters for the campaign were also seemingly kept at arm’s length: The Journal reports that “Biden’s pollsters didn’t meet with him in person and saw little evidence that the president was personally getting the data that they were sending him,” as the president often seemed unaware of the ample polling showing he was trailing Trump.

Years of such incidents culminated in Biden’s disastrous June 27 debate performance. President-elect Donald Trump will, like Biden, be 78 at his inauguration and 82 by the end of his term.

New research shows the massive hole Dems are in

Even voters who previously backed Democrats cast the party as weak and overly focused on diversity and elites.

The focus group research, shared first with POLITICO, represents the latest troubling pulse check for a party still sorting through the wreckage of its November losses and looking for a path to rebuild. | Jose Luis Magana/AP

Democrats conducting post-mortems on their sweeping losses in 2024 are finding more reason for alarm. And the problem isn’t just Kamala Harris or Joe Biden.

In a trio of focus groups, even voters who previously backed Democrats cast the party as weak and overly focused on diversity and elites, according to research by the progressive group Navigator Research.

When asked to compare the Democratic Party to an animal, one participant compared the party to an ostrich because “they’ve got their heads in the sand and are absolutely committed to their own ideas, even when they’re failing.” Another likened them to koalas, who “are complacent and lazy about getting policy wins that we really need.” Democrats, another said, are “not a friend of the working class anymore.”

The focus group research, shared first with POLITICO, represents the latest troubling pulse check for a party still sorting through the wreckage of its November losses and looking for a path to rebuild. Without a clear party leader and with losses across nearly every demographic in November, Democrats are walking into a second Trump presidency without a unified strategy to improve their electoral prospects. And while some Democrats blame Biden, others blame inflation and still others blame “losing hold of culture,” the feedback from the focus groups found Democrats’ problems are even more widespread and potentially long-lasting than a single election cycle.

The focus groups offer “a pretty scathing rebuke” of the Democratic Party brand, said Rachael Russell, director of polling and analytics at Navigator Research, a project within the Hub Project, which is a Democratic nonprofit group.

“This weakness they see, [Democrats] not getting things done, not being able to actually fight for people — is something that needs to be figured out,” Russell said. “It might not be the message, it might be the policy. It might be something a little bit deeper that has to be addressed by the party.”

The focus groups — held immediately after the 2024 election and conducted by GBAO, a Democratic polling firm — featured three kinds of voters: young men in battleground states who voted for Biden in 2020 and Trump in 2024; voters in battleground states who voted for Biden in 2020 but didn’t vote at all in 2024; and voters in blue states who had previously voted for Democrats, a third party candidate or didn’t vote in 2020 but voted for Trump in 2024.

“I think what the Democratic elites and their politicians believe is often very different from what the average Democratic voter is,” said a Georgia man who voted for Biden in 2020 but Trump in 2024. “The elites that run the Democratic Party — I think they’re way too obsessed with appealing to these very far-left social progressivism that’s very popular on college campuses.”

These voters voiced cautious optimism about Trump’s second term, both in the focus groups and a post-election poll that found Trump’s highest approval rating since 2020 in a GBAO survey. The national poll, which surveyed 1,000 people, found 47 percent viewed Trump favorably, while 50 percent disapproved of him — the highest marks he’s received since he left office.

Russell argued that Trump’s high marks reflect a “honeymoon” period, which she predicted will fade once he takes office: “Once things start happening, it’s going to take a turn, and so it’s going to rely really heavily on the actions in the first 100 days to see how we go from here.”

She also noted that the polling suggests openings for Democrats on issues like abortion, health care and taxing the rich, as well as a fear that Trump may go too far on tariffs. Their survey also showed that two-thirds of voters said inflation should be the incoming president’s top issue, but only a third of voters believed it was Trump’s or Republicans’ top issue.

When the focus group participants were asked about inflation and tariffs, many of them said they didn’t fully understand the policy, while others acknowledged they expected prices to go up.

“Obviously I wouldn’t want stuff to go up, but at the same time, in the long run, would it be better off for America and maybe having more stuff made here?” said one man from Wisconsin.

Even though the focus group voters did not solely blame Harris for their distaste of the Democratic Party, they also weren’t happy about her candidacy. Participants described her as “inauthentic,” “very dishonest” and “did not seem competent.”

An Arizona man, citing the time Harris said, “you better thank a union member,” during a speech in Detroit, said “that was very disingenuous to me because I didn’t see an honest person that could be president.”

“It seemed like a lot of what she came out and said wasn’t really off-the-cuff, wasn’t coming from her,” said another man who voted for Biden in 2020 and Trump in 2024. “Seemed like every interview, every time she came out and talked about something, it was planned out and never her thoughts, didn’t seem genuine to her thoughts, whereas, Trump, even though you never really knew what he was going to say, when he was going to say it, it was always him and genuine to what he thought, so that’s what swayed me.”

The feedback on Harris comes as the vice president mulls her own future, weighing a third presidential run against a bid for California governor in 2026. Some party loyalists have said they’d back another presidential run, arguing that Biden’s late exit from the race burdened the vice president’s three-month sprint. But others are not ready to get on board for it.

Several participants also raised the transgender attack ad that the Trump campaign deployed against Harris, which showed a 2019 clip of her expressing support for gender affirming surgery for state prison inmates. The ad’s tagline included: “Kamala is for they/them. President Trump is for you.”

Democrats disagree on the potency of the attack ad, but several participants raised it unprompted in the focus groups.

Lagging turnout was a major problem for Democrats in November. One woman from Georgia who didn’t vote in 2024 said that she didn’t agree with Harris’ “thinking that it’s okay for children to change their body parts.”

“I think that there needs to be some parameters on what’s accepted in society and what isn’t. Some of the societal norms, and I think that the Democrats have tried to open that up a little too much,” said a woman from Wisconsin who also didn’t vote in 2024.

When asked by the moderator if she was referring to the “trans issue,” the woman said, “primarily that.”

Trump wants to scrap Biden’s ban on a chunk of natural gas exports. It won’t help America’s top buyer much

President-elect Donald Trump is setto overturn a ban on some US exports of liquefied natural gas, or LNG, in a boon for US energy producers.

But the move is unlikely to help address the climate crisis and may even make it worse. As for the biggest buyer of American LNG — Europe — which depends heavily on natural gas imports, it will have to wait till after the end of the decade to see the benefit.

The region would welcome extra flows from January as, after nearly three bruising years of high energy prices, it is on the brink of losing one of its last remaining sources of Russian pipeline gas.

“The global gas market remains on edge heading into winter, unassuaged by warm winter weather predictions,” Bank of America strategists wrote in a note this month. “The market remains vulnerable due to relatively low inventories in Europe, the historical inaccuracy of weather forecasts, uncertainty around gas supplies from Russia and the startup timelines for new LNG projects.”

LNG is a chilled, liquid form of naturalgas that can be transported via sea tankers — and American exports are booming. In less than a decade, the United States has gone from selling negligible amounts of the fuel abroad to leapfrogging Australia and Qatar to become the world’s top supplier, according to the US Energy Information Administration (EIA).

Yet, in January, the Biden administration paused federal authorizations for several pending LNG export projects while it assessed the impact of the export boom on the environment and on energy security and prices at home. The pause does not apply to exports that had already been approved.

On Tuesday, the Department of Energy published that assessment, forecasting that, if the US increases LNG exports beyond what’s currently authorized, the resulting emissions would amount to an additional 1.5 gigatons of planet-warming pollution or so per year by 2050, equivalent to a quarter of current US annual greenhouse gas emissions.

The final decision on additional LNG exports is “in the hands of the next administration,” Energy Sec. Jennifer Granholm told reporters.

Some studies have found that LNG produces significantly less greenhouse gas pollution over its lifecycle than other fossil fuels, but its climate impact will depend on whether the gas is displacing oil and coal or, rather, clean renewable energy. Other studies have detected high rates of leakage of methane — the main component of LNG — at various points during the fuel’s production. Methane is a potent planet-heating gas, with 80 times more warming power over short timeframes than carbon dioxide.

Trump’s allies are already making plans to lift the LNG moratorium after he takes office in January, according to a source familiar with discussions among the incoming president’s advisers as well as candidates under consideration for national security roles.

Here is what this means for America’s biggest customer.

Europe’s energy makeover

Before Russia launched its full-scale invasion of Ukraine in 2022, Russia was the European Union’s biggest supplier of natural gas. Since then, the bloc whittled Moscow’s share of its imports down to 15% in 2023 from 45% in 2021 by slashing the supply arriving via pipeline.

To fill the gap, Europe has imported vast quantities of LNG from the US and other countries, as well as pipeline gas from Norway. Now, according to the EIA — which counts the United Kingdom and Turkey as part of Europe — the region is the biggest recipient of US LNG exports, soaking up two-thirds of the shipments last year.

The EU has also ramped up imports of Russian LNG to help heat its homes and power its factories. But the bloc faces a self-imposed deadline of 2027 to break its dependence on all fossil fuel imports from Moscow, setting the US up to play an even bigger role as the region’s energy supplier.

That independence day is still far off, however. Well before then, on January 1, 2025, a contract enabling the transit of Russian pipeline gas through Ukraine is set to expire. The flows represent about 5% of the EU’s total gas imports, according to Brussels-based think tank Bruegel, and supply mainly Austria, Hungary and Slovakia.

These countries are not at risk of an energy shortage, say analysts, noting they would likely fill the gap by importing more LNG or more natural gas via pipeline from other European nations.

But the loss of the flows via Ukraine will make it harder for Europe to refill its stores before next winter, said Massimo Di Odoardo, a senior natural gas researcher at energy data firm Wood Mackenzie.

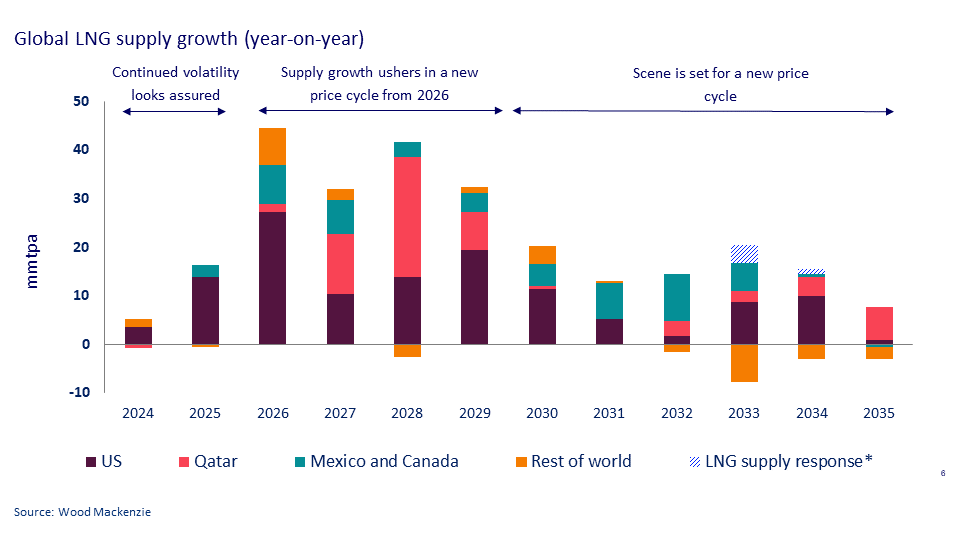

The global LNG supply is expected to grow only modestly over 2025, he told CNN, such that “Europe will struggle to get storage levels up to a very comfortable level at the end of next summer.”

Natural gas prices in Europe have tumbled from all-time highs reached in summer 2022 but are still more than double their historical levels. The end of the transit deal is one reason prices are unlikely to decline much next year, analysts told CNN. Di Odoardo said prices are likely to remain close to their current levels or perhaps rise if the contract is not renewed.

The oncoming glut

The picture should brighten for Europe in the second half of the decade, when a wave of fresh LNG supply from the US, Qatar and other producers is expected to hit the global market.

By the end of the decade, the amount of LNG trading in the world market is likely to be 50% higher than currently, excluding the potential supply from the currently pending US projects, according to Di Odoardo.

Any additional flows due to the reversal of Biden’s ban would not enter the market until after 2030, analysts said.

When they do, they will contribute to broader downward pressure on European natural gas prices.

In a note earlier this month, analysts at Capital Economics said their central forecast is for European prices to roughly halve from current levels by the end of 2026

Even so, prices are unlikely to return to their levels before Europe’s energy crisis, according to Francisco Blanch, head of commodities and derivatives research at Bank of America. Natural gas prices soared in the wake of Russia’s invasion, which followed a rise in global demand for energy as economies reopened after Covid lockdowns.

As long as Europe continues to import LNG across huge distances — crossing the Atlantic Ocean, for example — and not from an immediate neighbor, Blanch told CNN, it will bear the costs of transportation and other logistics.

It’s a predicament that puts European businesses at a competitive disadvantage to those in the US, which generally pay much less for their energy.

European natural gas prices are currently up to five times higher than those in the US, according to analysts at Capital Economics, who expect the gap to narrow by the end of 2026 — resulting in prices that are up to three times higher.

Writing in landmark report in September, Mario Draghi, the former chief of the European Central Bank, said that volatility in European energy prices is “also a significant factor, hampering energy-intensive industries and the entire economy.”

Likewise, Blanch at Bank of America makes a striking observation.

“(Companies) have been moving their operations away (from Europe),” he said. “If you have a heavy or chemical industry — which is a high-energy-intensity industry — you’re going to the US Gulf Coast. You’re going to the source of the energy.”

:max_bytes(150000):strip_icc():focal(754x308:756x310):format(webp)/missing-dog-buttercup-012126-1-66f5ee10e3ed49b4aaa3599c6ff3f8a2.jpg?w=1200&resize=1200,0&ssl=1)

:max_bytes(150000):strip_icc():focal(975x333:977x335)/ariana-grande-divorce-allegations-071823-tout-230550e499194da2b254c21d35d94f2f.jpg?w=1200&resize=1200,0&ssl=1)

:max_bytes(150000):strip_icc():focal(742x463:744x465)/Leann-Rimes-micro-toxins-treatment-012026-tout-a19f53d05d5c4da081be601d0e3a400e.jpg?w=1200&resize=1200,0&ssl=1)

:max_bytes(150000):strip_icc():focal(749x0:751x2):format(webp)/Katie-Bates-Pregnancy-Loss-011726-d6421e92f38a431b92ff1cd350c5226c.jpg?w=1200&resize=1200,0&ssl=1)